Good Advice For Selecting RSI Divergence Trading

Wiki Article

Good Reasons For Selecting An RSI Divergence Strategy

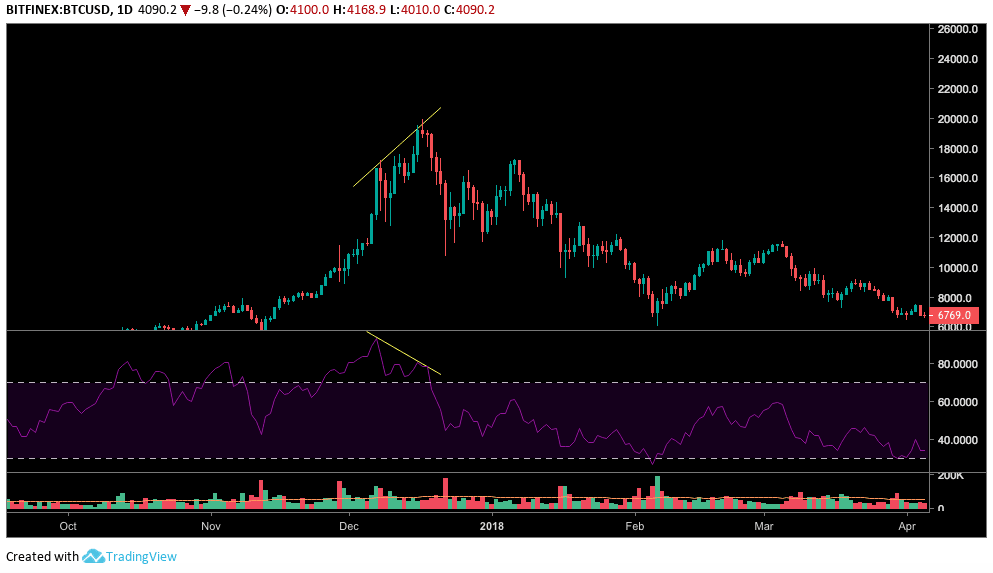

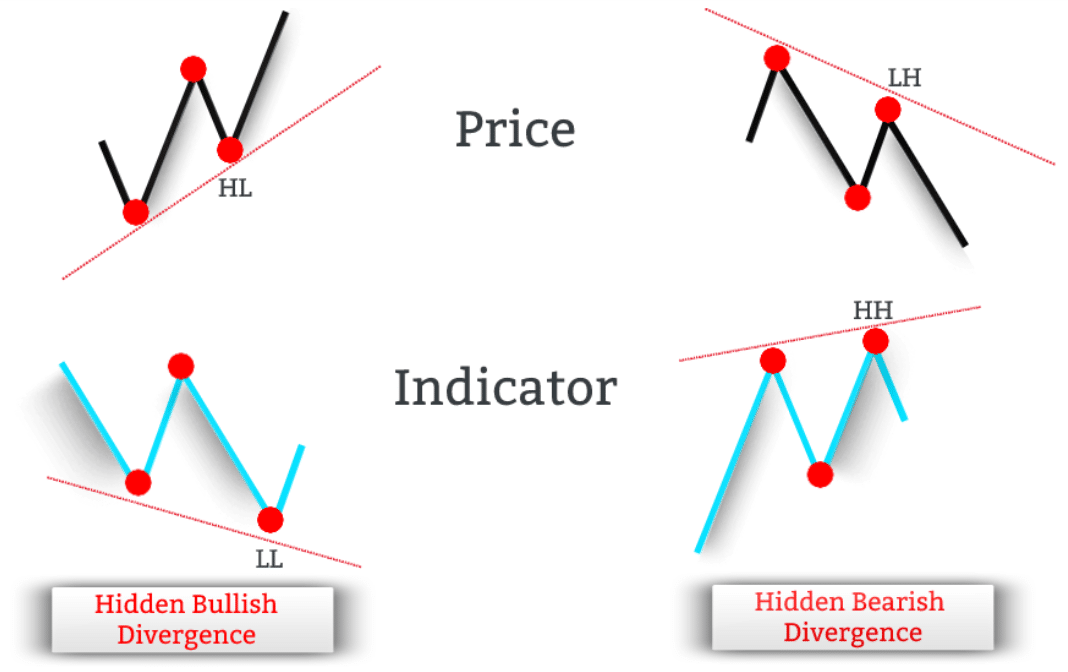

Let's begin with the obvious question. Let's explore what RSI Divergence looks like and what trading clues can be gleaned from it. A divergence is when the price movement is not aligned with the RSI indicator. Which mean, in the market that is trending down price makes a lower low. However, the RSI indicator makes higher lows. This means that divergence could be observed when the indicator does not agree to the price action. If this happens you must be aware. As per the chart, both bullish RSI divergence as well as the bearish RSI divergence are clear and the price movement was actually reversed following both RSI Divergence signals, isn't it? Let's get to one final topic before moving into the exciting topic. View the recommended forex backtester for website examples including backtesting strategies, best trading platform, trading platforms, backtesting strategies, online trading platform, crypto trading backtester, crypto backtesting, crypto trading backtesting, automated cryptocurrency trading, bot for crypto trading and more.

How Do You Analyze Rsi Divergence

Because we employ the RSI indicator to detect trend reversals, It is crucial to determine the most appropriate trend reversal in order to do this, we need to have a trending market, then we use RSI divergence to identify weaknesses of the current trend, and then use that information to identify the trend reversal at the right moment.

How Do You Spot Rsi Divergence In Forex Trading

Both Price Action and RSI both reached higher highs in the initial uptrend. This means that the trend is strong. When the trend is over, trend, price makes higher highs, and the RSI indicator makes lower highs. This indicates that there are things worth monitoring within this chart. This is where we need to be aware of the market since both the indicator and the price action are not in sync, which implies the market is experiencing an RSI divergence. In this case it is the RSI divergence suggests the trend is turning bearish. Look up at the chart to see the changes that occurred after the RSI diversification. It is evident that the RSI Divergence is extremely specific in identifying trends that reverse. Now, the issue is how do you spot the trend reversal. Let's look at four trade entry methods that give higher probability of entry when coupled with RSI divergence. See the recommended forex backtesting software free for blog recommendations including trading platform, crypto trading bot, bot for crypto trading, cryptocurrency trading, forex backtester, RSI divergence cheat sheet, forex backtester, online trading platform, automated trading software, forex backtesting and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

Two different versions of the triangle chart pattern are accessible. The pattern of the ascending triangle is used to reverse a downward trend. The descending Triangle pattern is used to reverse the trend of a market in an uptrend. The forex chart below displays the descending Triangle pattern. Like the previous illustration it was trending upwards and eventually the price start to fall. RSI also indicates divergence. These indicators indicate the weak points in the uptrend. We can see that the trend is slowing down. The price formed an descending triangle due to this. This is also a confirmation of the reverse. Now it's time to execute the trade. Like the previous example we utilized the same breakout techniques to execute this trade too. We will now examine the third trade entry strategy. This time we are going to pair trend structure with RSI divergence. Let's look at how to deal with RSI divergence when the trend structure is changing. Have a look at the recommended rsi divergence cheat sheet for site tips including forex trading, bot for crypto trading, backtesting, forex backtesting software free, cryptocurrency trading, cryptocurrency trading, cryptocurrency trading, online trading platform, crypto backtesting, stop loss and more.

Tip #2 – Combining RSI Divergence and the Head and Shoulders Pattern

RSI divergence is a technique that forex traders use to detect market reversals. You can increase the probability of trading by combing RSI diversence together with other factors that can cause reversals, such as the Head or Shoulders pattern. Let's find out how we can time our trades by combing RSI divergence with the head and shoulder pattern. Related: Trading Head and Shoulders Patterns in Forex: A Reversal Trading strategy. Prior to entering trades it is essential to have a favorable market. A trending market is preferable as we are trying to discover an opportunity to reverse the trend. Take a look at this chart. Take a look at most popular forex backtesting for blog recommendations including crypto trading backtester, backtesting tool, automated trading software, automated trading software, RSI divergence cheat sheet, cryptocurrency trading, trading platforms, forex backtesting software, forex backtesting, divergence trading forex and more.

Tip #3 – Combining RSI Diversity with the Trend Architecture

Trends are our best friend. We need to trade in the direction of trend as long as the market is trending. This is what professionals instruct us. The trend does not continue for a long time. It will eventually reverse. Let's look at how we can recognize those reversals by observing the structure of trends and RSI Divergence. As you are aware, the upward trend is making higher highs, while the downtrend is forming lower bottoms. So, with that in mind take a look at this chart below. On the left-hand part of the chart, you'll see a downtrend. There are many of lows and lower highs. Next, you can see the RSI deviation (Red Line). Price action can cause lows and Highs, however the RSI can create higher lows. What do these numbers mean? Even though the market creates low the RSI is doing the exact opposite thing. This indicates that the ongoing downtrend is losing its momentum and we should prepare for a reversal. Have a look at the top rated automated trading software for blog advice including best trading platform, trading platform, RSI divergence cheat sheet, forex trading, bot for crypto trading, forex backtesting software free, trading platform crypto, crypto trading backtesting, forex trading, backtester and more.

Tip #4 – Combining Rsi Divergence, The Double Top, And Double Bottom

Double-bottom or double-top is a reversal chart which is formed after a long movement or a trend. The double top forms when the price has reached a level that is not easily broken. The price will begin to recover after reaching this level but then it will test the levels previously tested. A DOUBLE TOP happens where the price bounces off this level. Check out the double top below. The double top that you see above shows two tops that were formed from a strong move. The second top is not able surpass the first. This is a clear indication that a reversal is likely to occur since it is warning that buyers are struggling to continuously go higher. Double bottoms are an example of the same principle, but with a reversed approach. In this case, we employ breakout entry. This means that we will sell the trade when the trigger line is beneath the price. The price surpassed our profit target within less than a day. QUICK PROFIT. You could also apply the same methods of trading for the double bottom. Check out the chart below to learn what you can do to trade RSI divergence in the event of the double bottom.

This isn't the most effective trading strategy. There is nothing called perfect trading strategy and all trading strategies have losses and must be dealt with. This trading strategy earns us consistently, but we use strict risk management and a way to minimize our losses rapidly. We are able to reduce the drawdown and open up possibilities for a huge upside potential.