Best Info For Deciding On Gold Price Prague

Wiki Article

What Are The Factors I Should Take Into Consideration When Purchasing Gold Bullion Or Coins For Investment In The Czech Republic

If you are thinking about investing in gold-based coins and bullion in Czech Republic, there are some factors to be considered. Authorized dealers or recognized institutions guarantee authenticity and high-quality.

Purity and weight- Confirm both the purity and the weight of the gold. Gold bullion can be found in different sizes and levels of purity (e.g. 22, 24 etc.). Make sure it is in compliance with standards for the standard specifications.

Understanding the Pricing Structure Discover about the price structure of gold, its spot price, and any additional charges dealers might charge. Compare prices to get the best bargain.

Storage and Security Think about safe and secure options to store your gold. Security concerns are a reason for some investors to choose to store their gold at the bank.

Selling Options and Liquidity Examine the ability to sell when you need to. Select metals or coins that are easy to sell and possess high liquidity. See the best Gold Czechia recommendations for website tips including buy gold coins, 1 10 oz american gold eagle, buying silver, chinese coins, sell gold coins, small gold coins, silver price in dollar, sell gold and silver near me, gold and bullion, gold stocks price and more.

What Can I Do To Determine Whether A Gold Product I Buy Is Authentic And Comes With The Correct Documents?

Take these steps to ensure the gold you buy comes with appropriate documentation and certificates for authenticity.

Find out about verification options - Certain certificates come with verification numbers and codes that you can use to verify their authenticity via the internet or over the phone. You can use these options to verify cross-verification. Talk to Third-Party Experts Ask for advice from independent experts appraisers or professional graders. They may be able to help you examine the papers and gold item to verify authenticity.

Compare to Known Standards - Compare provided documentation against industry standards and samples of certificates. This can be used to detect any inconsistencies and irregularities.

Trustworthy Sellers - Buy gold only from reputable and reputable dealers or authorized sellers who are well respected for their integrity and adhere to the industry's standards.

Keep receipts, certificates and all other documentation. It will be used as proof of purchase, and is useful in the future.

You can ensure that you're purchasing gold with authentic certificates by constantly examining and scrutinizing the documents and comparing it with industry standards, and contacting experts whenever needed. Check out the top rated buy coins Czechia advice for website info including gold and silver bullion, guardian angel coin, $20 gold piece, st gaudens double eagle, 1 ounce of silver, buying silver, ira gold investment, gold penny, gold and silver shops near me, nationwide gold and bullion reserve and more.

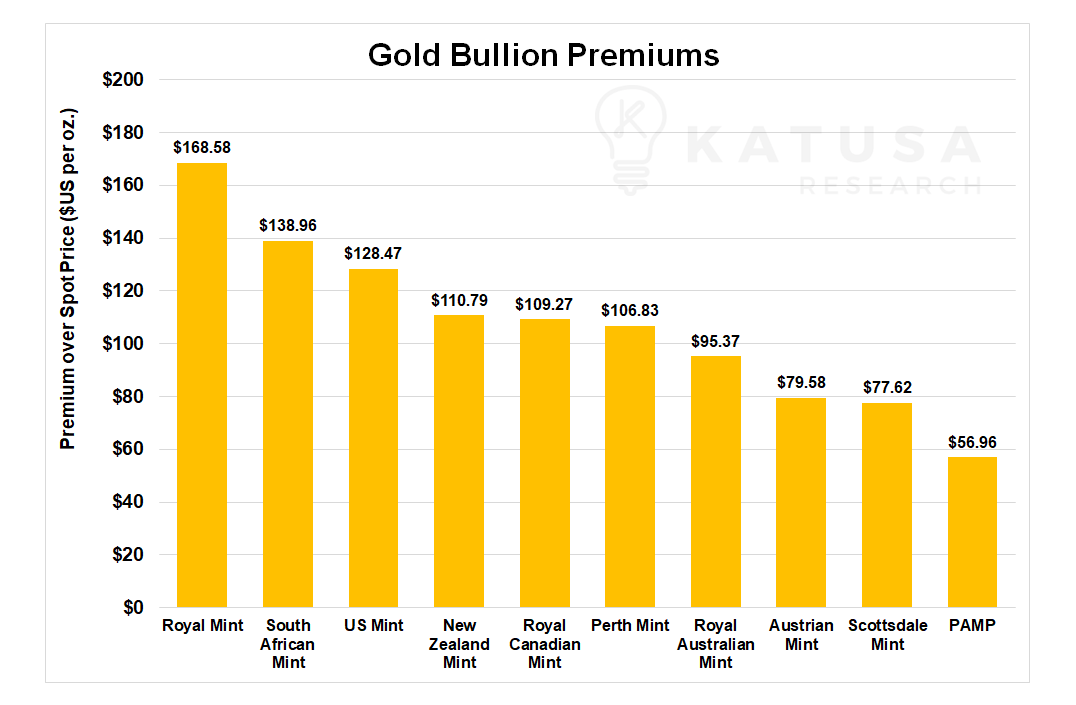

What Is A Small Mark-Up On The Stock Market And A Small Price Spread For Gold?

When it comes to trading gold low mark-ups and low price spread are the expenses associated with purchasing or selling gold compared to the market value. These terms are related to how much extra you may have to pay (markup) or the price difference between selling and buying prices (spread) above the market value of the gold. Low mark-up- This refers to a dealer who charges only a small premium over the market price. Low markup indicates that the price you pay is close to or just slightly higher than current market value.

Low Price Spread - The spread is the difference between the buying (bid) and selling (ask) prices of gold. A low price difference indicates an even wider spread between these two prices.

What Is The Average Price For Mark-Ups? Price Spreads Vary Across Different Gold Dealers?

Negotiability. Some sellers are more inclined to negotiate mark-ups on prices and spreads, particularly if the transaction is large or they have repeat customers. Geographical Location. Mark-ups are influenced by local regulations and taxes as well as regional factors. Dealers in areas with more regulations or taxes may transfer the cost to customers.

Product Types And Availability- The markups or spreads could differ based on the kind of gold products you are buying (coins bars and collectibles,). Due to their rarity rare and collectibles can command higher markups.

Market Conditions- If there is a large demand for goods, a shortage or market volatility dealers will increase their spreads as a way to reduce the risk of losing money or to cover the losses.

It is crucial for gold investors, based on these elements that they conduct thorough study to compare prices, and consider other aspects like reputation, reliability and customer support when choosing the right seller. It's important to look around to get quotes and compare prices from various dealers. This will enable you to determine the best price for gold. Read the top coins Prague hints for site tips including silver double eagle, ngc grading, gold panda coin, gold and silver buyers near me, 24k gold coin, 1 4 oz gold coin, gold coins, gold quarter dollar, price for one ounce of gold, sacagawea gold dollar and more.