Great Suggestions For Choosing Forex Trading Websites

Wiki Article

Ten Tips To Gain A Greater Understanding Of The Forex Market And Its Strategies To Use When Trading Forex Online

Forex trading can be difficult, but with the right market knowledge and strategy, you can reduce risk and improve the chances of success. Here are ten tips on how to trade Forex online, using market information.

Know the Economic Indicators

In Forex economic indicators (such as unemployment rates and GDP growth reports) are important as they reveal the health of the economy. As an example, high employment figures from the U.S. usually strengthen the USD. Keep up-to-date on the schedule of economic events.

2. Concentrate on the management of risk

Establish risk management practices at the very beginning. Set take-profit and stop-loss levels to protect your investments and limit losses. A lot of traders recommend that you only take on just a small percentage of your account for each trade (e.g. 1 to 2 percent)

3. Use Leverage With Care

Leverage increases both gains and losses, so be cautious. Although brokers offer high leverage however, it's best to begin with lower leverage until you understand the market and how leverage impacts your investments. In excess, leverage can cause massive losses.

4. Plan your trades

A solid trading strategy can help you keep your focus. Determine the objectives you're looking to achieve, as well as your entries and exits and the risk you are willing to take. The plan should outline the strategies you'll employ depending on fundamental analysis, technical analysis, or a mix of both.

5. Learn the Fundamentals of Technical Analysis

Understanding technical analysis in Forex trading is essential. Know about moving averages, candlestick patterns Support and resistance levels along with trend lines and other analysis tools. These tools aid in identifying potential trading opportunities and manage entry/exit point effectively.

6. Global News: Stay up to the

Natural disasters, central bank policies, trade agreements and political events can all influence currency markets. A surprise cut by a central bank in interest rates could cause its currency to weaken. You can anticipate market changes by keeping up-to-date with global news.

7. Which Currency Pairs Should You Use?

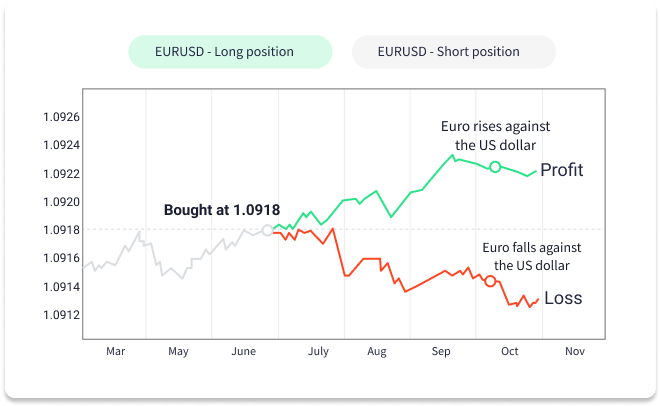

For beginners, it is possible to choose currency pairs such as EUR/USD and GBP/USD as they are stable and liquid. Currency pairs that are exotic, even though they may sometimes offer high returns, are usually more unpredictable and more risky. Understanding the characteristics helps you to choose currency pairs that fit your preferences for trading and risk tolerance.

8. Demo accounts are accessible to try out.

Before you begin trading live, use a demo account to practice strategies and get familiar with the trading platform. This approach helps you gain confidence, try out your strategy, and make mistakes in a safe environment.

9. Examine the central bank's interest rates and policies

The monetary and interest rates have a huge impact on the value of currencies for central banks. Higher interest rates can attract foreign investors, thereby strengthening the currency, while lower rates might reduce its strength. It is possible to gain insights into the trends in currency by following the decisions of the Federal Reserve or European Central Bank.

10. Keep a Journal of Your Trades

A comprehensive journal of your trading activities will allow you to improve your discipline, and will also reveal your strengths and weakness. Document all transactions, including reasons behind trading entries and exits, the times of entry and departure as well as the results. Analyzing this document over time may identify patterns in your trading behavior and assist you improve your strategy.

In summary the success of Forex trading depends on thorough market knowledge as well as strategic planning and a well-planned execution. Stay informed, control your risk, and modify strategies as the market changes. View the most popular https://th.roboforex.com/ for more advice including forex trading strategies, best forex trading app, best currency trading platform, forexcom, fx forex trading, forex trading app, broker forex usa, fx trading forex, brokers for forex in usa, forexcom and more.

Ten Suggestions To Prepare You Mentally Before You Trade Forex Online

Forex trading heavily relies on the psychological side of things, as the mental and emotional strength directly affect the decisions made. Here are ten top tips on how to develop the ideal mindset to be prepared for Forex trading.

Recognize Emotions and Control Them

1. Trading can bring out strong emotions such as greed or fear, anger or even joy. To be able to control these emotions you must first identify them. Stay calm and collected even if you lose or win, as emotions may result in impulsive decision-making. Consistency is only possible with disciplined trading.

2. Accept that losses are a part of Trading

Every trader has to deal with losses. Accepting that losses are part of the learning and trading processes can reduce the emotional burden. Instead of being focused on each outcome, focus on your performance over time. This helps you deal with backslides while moving forward.

3. Create realistic expectations

Forex trading isn't a scheme to make money fast. People who are new to trading often have unrealistic goals such as double their accounts in a matter of hours. This can result in excessive risk taking. Set realistic, achievable goals based on your previous experience as well as your capital and time commitment. This keeps you grounded and reduces frustration.

4. A trading plan is a must.

A trading strategy defines your strategy and your risk tolerance. It also defines the criteria you employ for making trades. This plan guides you through various market situations. Sticking with your plan helps to avoid making uninformed decisions and lets you follow a systematic strategy rather than reacting to fluctuations in the short term.

5. You can learn patience and discipline

It is crucial to be patient and wait for the best trading opportunities, rather than making trades just because you're bored or impatient. Follow your plan with discipline, even when you are tempted to deviate from it. It is essential to remember that success in trading isn't about the number of transactions, but the quality of them.

6. Stress Management with Healthy Habits

Management of stress is vital to maintain mental clarity. Maintain a balanced mind by implementing habits like regular exercise, adequate sleep and taking breaks during trading sessions. Self-care is crucial to maintain focus and clarity. Stress levels high could cause a clouded judgement.

7. Maintain a separate personal life from the world of trading

Don't let your personal issues or anxieties affect your trading. Be clear and keep your personal life separated from your trading mind. Set limits and don't trade during stressful times. Emotional decisions can result.

8. Avoid Revenge Trading

After losing a trade Many traders experience the desire to get revenge by trading once more. The process of "revenge trading" usually leads to more impulsive decisions and bigger losses. After a bad loss it is important to think about what went wrong, and then be patient for an opportunity which is planned.

9. Be flexible and learn to change.

The market is constantly changing and even the most successful strategies might not work every time. Being prepared mentally to change and evolve your approach, instead of clinging to one method, boosts your resiliency. Flexibility is key to avoiding frustration and seeing adjustments as a necessary element of growing.

10. Keep an Trading Journal.

Keep a log of your trading activities, including specifics on your decisions and emotions in order to spot patterns. By regularly reviewing your journal, it is possible to detect emotional patterns. You can also enhance the strategies you employ and improve your mental agility.

When it comes to Forex trading, the correct mental preparedness can make the difference between successful traders from those who struggle. Through focusing on emotion control, patience, discipline, and self-control, you'll increase your capacity to make choices and be more resilient in the face changes in the market. Have a look at the top rated for website examples including fx trading platform, forex brokers usa, forex trading brokers, forex trading brokers list, forex market online, fx forex trading, forex exchange platform, forex trading strategies, trader fx, forex trading brokers and more.

The Most Effective 10 Demo Trading And Skill Development Strategies In Forex Trading Online

Demo accounts are an excellent method to improve your trading skills and gain confidence before trading with real money. Here are 10 ways on how you can improve your Forex trading skills and increase your demo account experience.

Treat Your Demo Account Like a Real Account

1. Demo trading should be handled with the same level of commitment as with a real account. Set your risk limit and prepare trades as if you had real money on the line. This helps you build good habits which can be carried over to live trading.

2. Develop and test a trading Plan

Use the demo to develop a sound trading strategy including rules for entry and exit as well as risk management and position size. Try it out on a variety of trades in various market conditions. The results will help you to refine your strategy and come up with an approach that is consistent.

3. How to utilize the trading platform

Be familiar with your trading platform and its features. Charting tools are important along with options for order types and risk management options. This will improve your confidence and effectiveness, decreasing the possibility of making mistakes once you move to live trading.

4. Different Trading Strategies

Demo accounts offer an opportunity to test various methods (such as daytrading or swing trading) and find out what works for you. Examine each strategy and its strengths, weaknesses and suitability with your style of trading as well as your schedule and personal.

5. Utilize Risk Management Methods

Use your demo account to test making stop-losses, determining the right size of positions and making use of leverage with care. To achieve long-term growth, it's essential to master the ability to effectively manage risk.

6. Track, analyze and analyze your trades

Keep a detailed trading diary where you record every trade. It should contain the reason for entry and departure, trade results, and any feelings you experience during the trade. Reviewing your journal regularly helps you find areas of improvement and helps you improve your trading strategy.

7. Simulate Market Conditions

Try to mimic the kinds and amounts of trades you'd use in real-world accounts. Beware of overly big or unrealistic trades, since these won't be a true reflection of the conditions you'll face when trading with your own money.

8. Try Yourself in a variety of Market Conditions

Forex markets are different in different situations (trending or moving, volatile or calm). Demo accounts are a great way to test strategies under different circumstances, such as during news events of great impact or in times that are low in volatility. You'll be better prepared to deal with different situations when trading live.

9. Gradually Increase Complexity

Before introducing advanced tools or timeframes begin with basic strategies or indicators. Gradually, you will increase your proficiency and proficiency with advanced methods. This step-bystep method will help you grasp the basics before tackling complex strategies.

10. Set a limit time for demo trading

While demo trading is essential however, you shouldn't stay in the demo phase for too long. Think about moving your account to a live one by making a small initial deposit once you are consistently profitable and confident about your plan of action. Demo trading isn't able to replicate real-time trading.

By following these guidelines, you can increase your demo-trading experience, develop trade skills that are efficient, and create the foundations to be successful in real Forex trading. Make sure you practice with consistency, discipline, and keep an eye on continual improvements. Follow the top rated https://th.roboforex.com/clients/services/up-to-10-percents-on-account-balance/ for more examples including forex app trading, united states forex brokers, best forex trading broker, forex trading brokers, broker forex usa, best broker for currency trading, top forex trading apps, 4x trading, broker forex usa, currency trading platforms and more.